Delving into long-term returns of BSE Midcap Index, this introduction immerses readers in a unique and compelling narrative. It provides a detailed overview of what the index represents in the stock market, how it is calculated, and examples of companies listed in it.

The importance of long-term returns, factors influencing them, and strategies for maximizing returns are also discussed in detail.

Overview of BSE Midcap Index

The BSE Midcap Index represents a segment of the stock market that includes medium-sized companies that are not as large as those in the BSE Sensex but are bigger than the ones in the BSE Small Cap Index. These midcap companies are known for their potential for growth and can offer higher returns compared to large-cap companies.The BSE Midcap Index is calculated based on the market capitalization of the midcap companies listed on the Bombay Stock Exchange.

Market capitalization is calculated by multiplying the total number of outstanding shares of a company by its current market price per share. The index is a free-float market capitalization-weighted index, which means that the weightage of each stock in the index is determined by its free-float market capitalization.

Companies listed in the BSE Midcap Index

The BSE Midcap Index includes companies from various sectors such as finance, healthcare, consumer goods, technology, and more. Some examples of companies listed in the BSE Midcap Index are:

- HDFC Life Insurance Company Ltd.

- Tata Power Company Ltd.

- Adani Transmission Ltd.

- Cadila Healthcare Ltd.

- Shriram Transport Finance Company Ltd.

Importance of Long-Term Returns

Long-term returns are crucial for investors as they provide a clear picture of how an investment performs over an extended period, typically five years or more. Investors consider long-term returns important because they help in evaluating the overall performance of an investment, taking into account market volatility and fluctuations.

When comparing short-term versus long-term investment strategies, short-term investments are more focused on immediate gains and are often subject to market volatility. On the other hand, long-term investments allow investors to ride out market fluctuations and benefit from compounding returns over time.

Contributions to Portfolio Growth and Wealth Creation

Long-term returns play a significant role in portfolio growth and wealth creation. By staying invested for the long term, investors can benefit from the power of compounding, where returns earned on an investment are reinvested to generate additional returns. This compounding effect can significantly boost the overall value of the investment portfolio over time.

Factors Influencing Long-Term Returns of BSE Midcap Index

When it comes to the long-term returns of the BSE Midcap Index, several key factors play a crucial role in shaping its performance over time. Understanding these factors is essential for investors looking to make informed decisions.

Economic Conditions Impact

The performance of midcap stocks within the BSE Midcap Index is heavily influenced by overall economic conditions. Factors such as GDP growth, inflation rates, interest rates, and government policies can all impact the profitability and growth potential of midcap companies.

During periods of economic expansion, midcap stocks tend to perform well as they benefit from increased consumer spending and business investment. On the other hand, during economic downturns, midcap stocks may face challenges due to reduced consumer demand and tighter credit conditions.

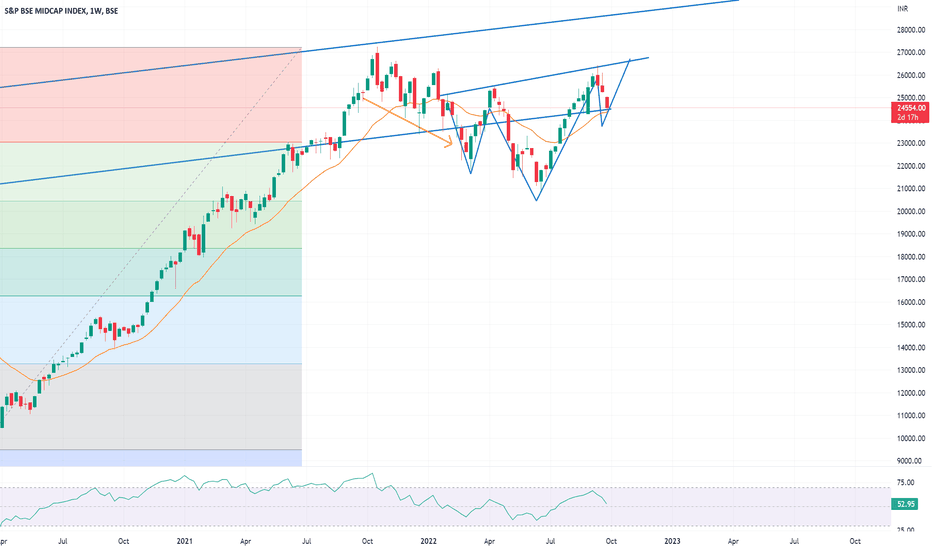

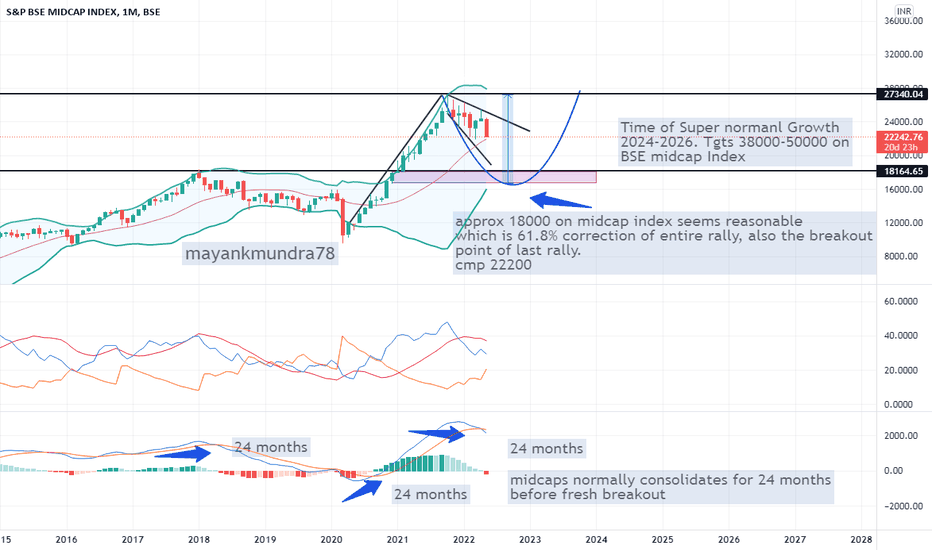

Historical Trends Analysis

Analyzing historical trends is crucial to understanding the volatility and stability of long-term returns of the BSE Midcap Index. By studying past performance data, investors can identify patterns and cycles that may impact future returns. Historical trends can also provide valuable insights into how midcap stocks have performed during different market conditions and economic environments.

This analysis helps investors make more informed decisions and manage their risk effectively.

Strategies for Maximizing Long-Term Returns

Investing in the BSE Midcap Index can offer great potential for long-term returns, but it’s essential to have a solid strategy in place to maximize those returns effectively. By following specific investment strategies tailored for midcap stocks and implementing diversification techniques, investors can manage risk and enhance returns over time.

Investment Strategies for BSE Midcap Index

One successful investment approach for maximizing long-term returns in the BSE Midcap Index is to focus on growth stocks within the midcap segment. These are companies with high growth potential that can deliver substantial returns over time. By identifying and investing in such growth stocks, investors can capitalize on the growth trajectory of these companies and benefit from their increasing market value.

Another effective strategy is to adopt a buy-and-hold approach when investing in the BSE Midcap Index. Instead of trying to time the market or engage in frequent trading, holding onto midcap stocks for the long term can allow investors to benefit from the overall growth of the index and ride out any short-term market fluctuations.

Diversification Techniques

Diversification is key to managing risk and enhancing returns when investing in the BSE Midcap Index. By spreading investments across different sectors and industries within the midcap segment, investors can reduce the impact of any individual stock underperforming. This helps to protect the overall portfolio from significant losses and can lead to more stable long-term returns.

Additionally, diversifying across asset classes can further enhance portfolio resilience. By including a mix of stocks, bonds, and other assets in the investment portfolio, investors can reduce overall risk exposure and potentially improve returns over time. This balanced approach to diversification can help investors navigate market volatility and achieve more consistent long-term growth.

Concluding Remarks

In conclusion, the long-term returns of BSE Midcap Index play a crucial role in investors’ portfolios. By understanding the key factors influencing these returns and implementing effective strategies, investors can maximize their wealth creation potential.

FAQ Insights

What is the significance of long-term returns in the BSE Midcap Index?

Long-term returns in the BSE Midcap Index are important as they reflect the performance of midcap stocks over an extended period, providing insights into wealth creation potential.

How do economic conditions impact the long-term returns of the BSE Midcap Index?

Economic conditions can influence midcap stock performance, affecting the long-term returns of the BSE Midcap Index. Factors like GDP growth, inflation, and interest rates play a role.

What are some successful investment approaches tailored for midcap stocks in the BSE Midcap Index?

Successful investment approaches for midcap stocks include thorough research, diversification, and a long-term perspective to capitalize on growth opportunities.