With top BSE midcap index companies 2025 in focus, this paragraph sets the stage for an exciting exploration of the companies poised for success in the coming years. Get ready to delve into a world of market insights and financial analysis that will shape investment decisions.

Highlighting the top BSE midcap index companies expected to shine in 2025 and the criteria determining their success, this discussion promises to be both informative and intriguing.

Top BSE Midcap Index Companies 2025

As we look ahead to 2025, several companies within the BSE Midcap Index are expected to stand out for their performance. These companies have shown promising growth potential and are likely to continue their upward trajectory in the coming years.

Criteria for Top Companies

The top companies in the BSE Midcap Index are typically selected based on a combination of factors such as revenue growth, profitability, market share, innovation, and overall financial health. These companies have a track record of delivering consistent returns to investors and are well-positioned to capitalize on market opportunities.

Historical Performance and Future Prospects

Companies that have historically performed well in the BSE Midcap Index have often demonstrated strong fundamentals, effective management, and a clear growth strategy. Their past performance can provide valuable insights into their future prospects, as companies with a history of success are more likely to continue delivering positive results.

Market Trends and Analysis

In recent years, the BSE Midcap Index companies have experienced significant growth and development, influenced by various market trends. These trends have played a crucial role in shaping the performance of these companies and impacting the overall index.

Factors Driving Growth

- The rise of digital transformation and technology adoption has propelled many midcap companies towards innovation and efficiency, leading to increased productivity and competitiveness in the market.

- Changing consumer preferences and the shift towards sustainable practices have driven midcap companies to focus on ESG (Environmental, Social, and Governance) factors, attracting socially responsible investors and enhancing their market value.

- Strategic mergers and acquisitions have provided opportunities for midcap companies to expand their market presence, diversify their product offerings, and achieve economies of scale, contributing to their growth trajectory.

- The supportive regulatory environment and government policies aimed at fostering entrepreneurship and promoting ease of doing business have created a conducive atmosphere for midcap companies to thrive and capitalize on emerging opportunities.

Comparison with Other Indices

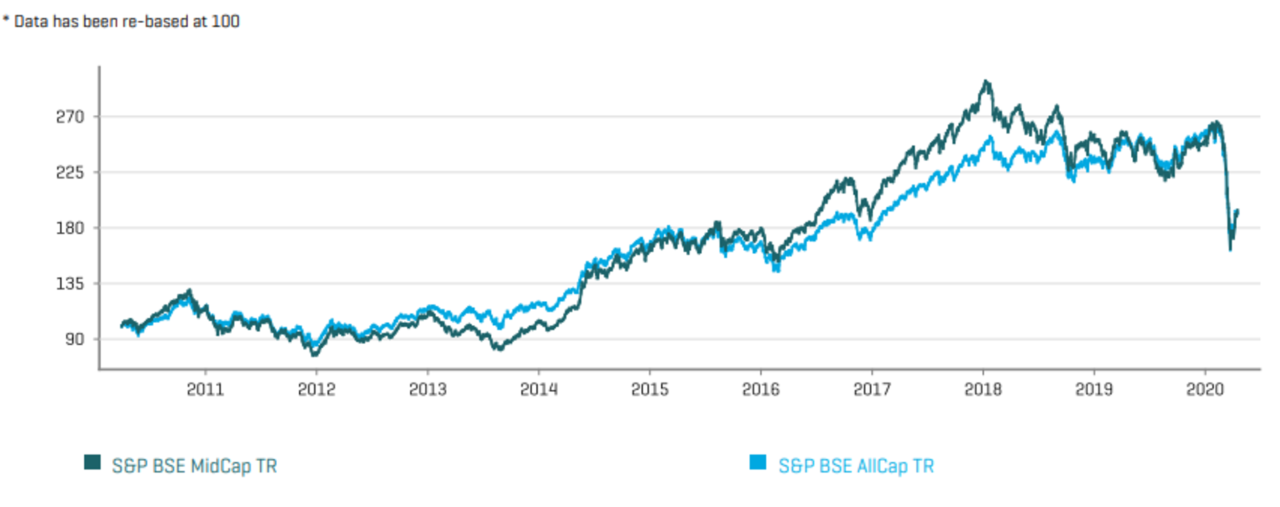

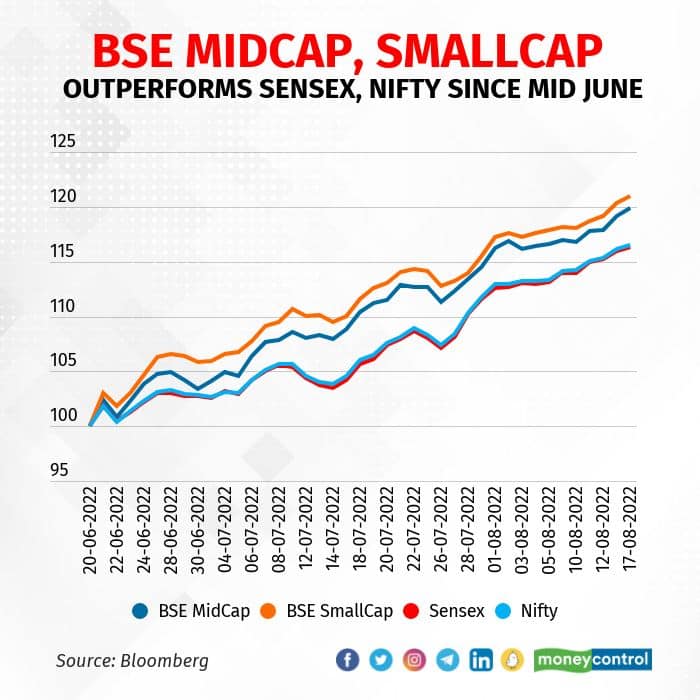

- When compared to large-cap indices, the BSE Midcap Index companies have shown higher growth potential and agility, benefiting from their ability to adapt quickly to changing market dynamics and capitalize on niche market segments.

- Unlike small-cap indices, the midcap companies in the BSE Midcap Index exhibit a more stable growth trajectory and lower volatility, making them an attractive investment option for risk-averse investors seeking moderate returns with controlled risk exposure.

- The BSE Midcap Index companies have demonstrated resilience in the face of market fluctuations and economic uncertainties, outperforming broader indices during challenging times and showcasing their ability to deliver consistent returns over the long term.

Financial Performance

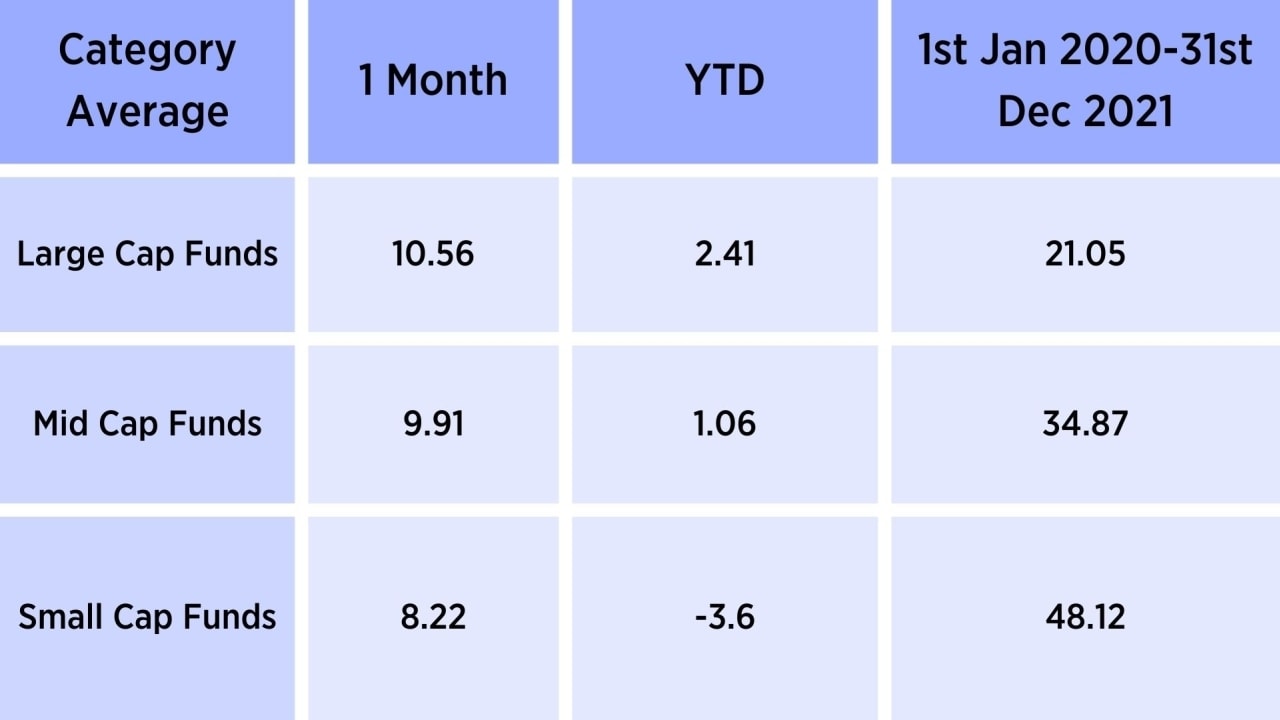

Investors often rely on various financial performance metrics to evaluate the health and potential growth of companies listed in the top BSE Midcap Index. These metrics help investors make informed decisions about where to allocate their funds for maximum returns.

Overview of Financial Performance Metrics

- Revenue Growth: This metric indicates the rate at which a company’s sales are increasing over time. Higher revenue growth is generally a positive sign of a company’s performance.

- Profit Margin: The profit margin shows how efficiently a company is operating by measuring the percentage of revenue that translates into profit. A higher profit margin is usually preferable.

- Return on Equity (ROE): ROE measures a company’s profitability by showing how much profit it generates with the shareholders’ equity. A higher ROE signifies better performance.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt a company uses to finance its operations compared to shareholders’ equity. A lower ratio is generally considered more favorable.

Comparative Analysis of Financial Ratios

| Company | Revenue Growth | Profit Margin | ROE | Debt-to-Equity Ratio |

|---|---|---|---|---|

| Company A | 15% | 12% | 18% | 0.5 |

| Company B | 10% | 10% | 15% | 0.6 |

| Company C | 20% | 14% | 20% | 0.4 |

Influencing Investor Decisions

- The financial performance of these companies can heavily influence investor decisions in 2025. Companies with strong revenue growth, high profit margins, and solid ROE are likely to attract more investors looking for growth opportunities.

- Investors may also favor companies with lower debt-to-equity ratios as they are considered less risky and more financially stable in the long run.

- By analyzing the financial ratios of these top BSE Midcap Index companies, investors can make informed decisions based on the companies’ stability, potential for growth, and overall financial health.

Industry Analysis

In analyzing the industries represented by the top BSE Midcap Index companies for 2025, it is essential to consider their growth prospects, competitive landscape, and potential regulatory or market changes. These factors play a crucial role in shaping the performance of these companies and the overall index.

Information Technology

The Information Technology sector continues to be a significant player among the top BSE Midcap Index companies. With the increasing demand for digital transformation, cloud computing, and cybersecurity solutions, IT companies are expected to experience robust growth in 2025. Companies in this sector are focusing on innovation and agility to stay competitive in the market.

Financial Services

The Financial Services industry is another key component of the top BSE Midcap Index companies. With the rise of fintech and digital banking services, financial institutions are adapting to new technologies to enhance customer experience and improve operational efficiency. The competitive landscape in this industry is intense, with companies vying for market share and exploring new revenue streams.

Healthcare

The Healthcare sector is poised for growth in 2025, driven by increasing healthcare spending, advancements in medical technology, and a growing focus on preventive care. Companies in this industry are investing in research and development to bring innovative healthcare solutions to the market.

The regulatory environment plays a crucial role in shaping the future of healthcare companies, with changes in healthcare policies and regulations potentially impacting their operations.

Consumer Goods

The Consumer Goods industry is also represented among the top BSE Midcap Index companies, with companies focusing on product innovation, sustainability, and e-commerce strategies. The competitive landscape in this sector is evolving rapidly, with companies adapting to changing consumer preferences and market trends.

Regulatory changes related to consumer protection and sustainability practices could impact the performance of companies in this industry.

Automobile

The Automobile sector is facing challenges and opportunities in 2025, with companies focusing on electric vehicles, autonomous driving technology, and sustainable mobility solutions. The competitive landscape in the automotive industry is fierce, with companies investing heavily in research and development to stay ahead of the curve.

Regulatory changes related to emissions standards and safety regulations could influence the strategies of automobile companies in the coming years.

Closing Summary

As we wrap up our journey through the top BSE midcap index companies of 2025, it’s clear that these companies hold immense potential for growth and stability in the market. Keep a close eye on their financial performance and industry trends to make well-informed investment choices moving forward.

Clarifying Questions

What criteria are used to determine the top BSE Midcap Index companies for 2025?

The top companies are selected based on their expected performance and historical track record.

How do market trends influence the growth of BSE Midcap Index companies?

Market trends play a crucial role in shaping the growth and performance of these companies, impacting their overall success.

Which industries are represented by the top BSE Midcap Index companies for 2025?

Various industries such as technology, healthcare, and finance are represented, each with unique growth prospects.