Delving into BSE midcap vs small cap returns, this introduction immerses readers in a unique and compelling narrative. Understanding the differences in performance between midcap and small cap stocks is crucial for investors looking to maximize their returns in the market.

This analysis will explore historical performance, volatility, risk assessment, sectoral allocation impact, and more, providing valuable insights for investors navigating the midcap and small cap segments.

Introduction to BSE Midcap and Small Cap Returns

BSE Midcap and Small Cap indices are key benchmarks that track the performance of mid-sized and small-sized companies listed on the Bombay Stock Exchange (BSE) in India. These indices are important indicators of the overall health and growth potential of companies operating in the midcap and small cap segments.

Tracking returns in midcap and small cap segments is significant for investors looking to diversify their portfolios and potentially achieve higher returns. While large-cap stocks offer stability and lower risk, midcap and small cap stocks have the potential for higher growth rates, making them attractive options for investors seeking capital appreciation.

Differences in Investment Strategies

Investing in midcap and small cap stocks requires a different approach compared to large-cap stocks. Here are some key differences in investment strategies:

- Greater Growth Potential: Midcap and small cap stocks have a higher growth potential compared to large-cap stocks due to their smaller market capitalization and growth opportunities.

- Higher Volatility: Midcap and small cap stocks tend to be more volatile than large-cap stocks, which can lead to higher risks but also higher rewards for investors.

- Research and Due Diligence: Investing in midcap and small cap stocks requires thorough research and due diligence to identify companies with strong growth prospects and sound fundamentals.

- Diversification: Including midcap and small cap stocks in a portfolio can help diversify risk and potentially enhance returns by tapping into different market segments.

Historical Performance Analysis

Historical performance analysis of BSE Midcap and Small Cap indices provides valuable insights into the trends and patterns of these market segments.

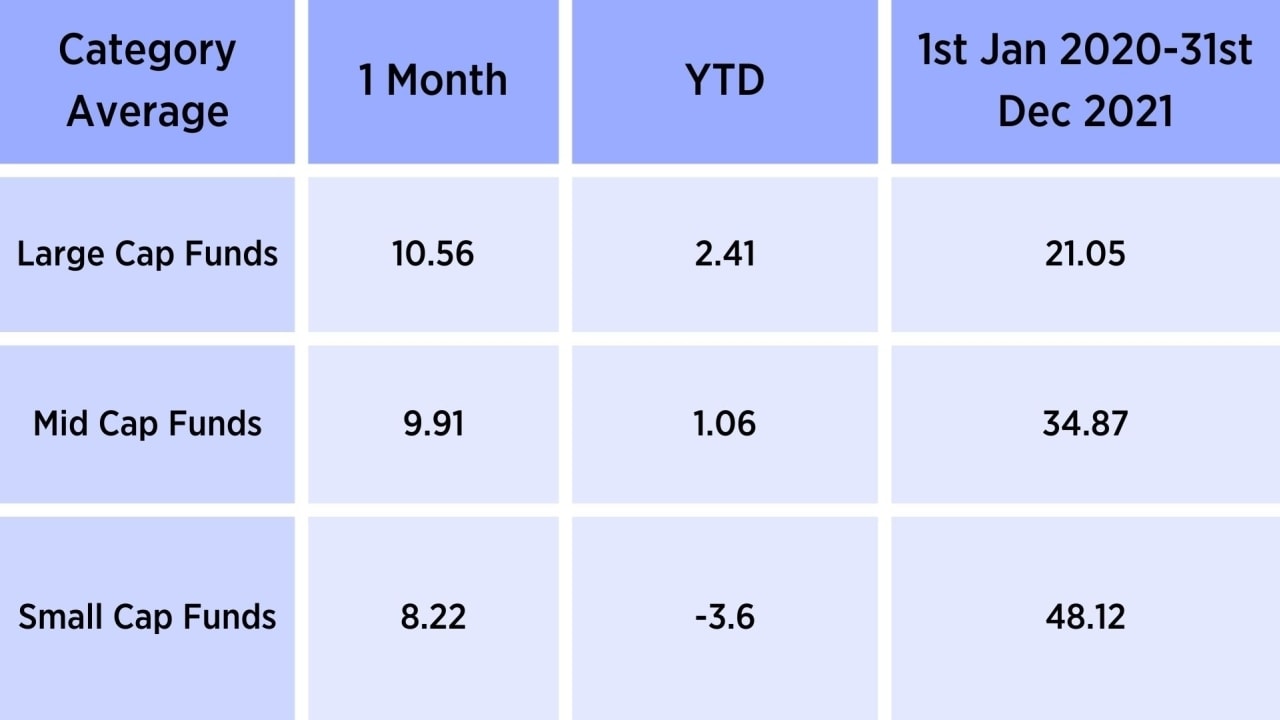

Comparison of Historical Returns

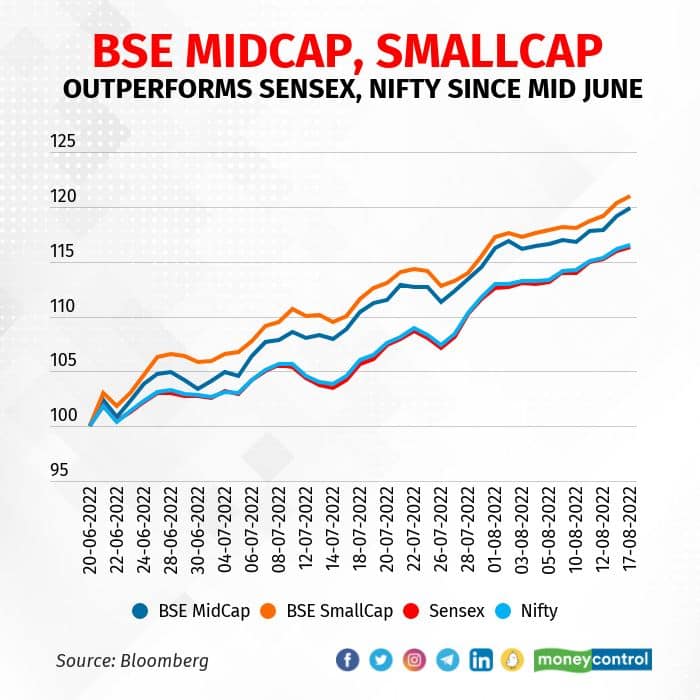

When comparing the historical returns of BSE Midcap and Small Cap indices over a specific period, it is important to note that both segments have shown varying levels of performance. While the midcap stocks have generally outperformed small cap stocks in terms of returns over the long term, small cap stocks tend to be more volatile and can provide higher returns in certain market conditions.

Patterns and Trends in Performance

One common trend observed in the historical performance of midcap and small cap stocks is that midcap stocks tend to offer more stable returns over the long term, while small cap stocks exhibit higher growth potential but also higher risk.

Additionally, during periods of economic expansion, small cap stocks have shown the potential to outperform midcap stocks due to their higher sensitivity to market conditions.

Factors Influencing Historical Performance

Several factors influence the historical performance of midcap and small cap indices, including market trends, economic conditions, sectoral performance, and investor sentiment. Economic indicators such as GDP growth, inflation rates, and interest rates can also impact the performance of midcap and small cap stocks.

Additionally, company-specific factors such as earnings growth, management quality, and competitive positioning play a crucial role in determining the historical performance of these indices.

Volatility and Risk Assessment

When it comes to investing in the stock market, understanding the volatility and risk associated with different types of indices is crucial for making informed decisions. Let’s take a closer look at how the BSE Midcap and Small Cap indices compare in terms of volatility and risk.

Volatility Levels

Volatility is a measure of how much the price of a stock or index fluctuates over a period of time. In general, small cap stocks are known to be more volatile compared to midcap stocks. This means that investing in small cap stocks can potentially offer higher returns, but it also comes with increased risk due to the higher level of volatility.

Risk Comparison

- Small cap stocks typically have a higher risk compared to midcap stocks due to their smaller market capitalization and lower liquidity. This makes them more susceptible to market fluctuations and economic downturns.

- On the other hand, midcap stocks are considered to be less risky than small caps but still offer higher growth potential compared to large cap stocks. They strike a balance between risk and return, making them a popular choice for many investors.

Risk Management Strategies

- Diversification: Investors can manage risk by diversifying their portfolio across different asset classes, sectors, and market caps. This helps spread out risk and reduce the impact of any single stock’s performance on the overall portfolio.

- Research and Due Diligence: Conducting thorough research and analysis before investing in midcap or small cap stocks can help investors make more informed decisions and mitigate potential risks.

- Setting Stop-Loss Orders: Setting stop-loss orders can help investors limit their losses by automatically selling a stock when it reaches a predetermined price level, protecting them from significant downturns.

- Regular Monitoring: Keeping a close eye on the performance of midcap and small cap stocks within a portfolio is essential for identifying any potential risks early on and making necessary adjustments.

Sectoral Allocation Impact

Sectoral allocation plays a crucial role in determining the returns of midcap and small cap stocks. The performance of BSE Midcap and Small Cap indices is heavily influenced by sectoral trends and the allocation of stocks within these sectors.

Impact of Sectoral Trends

Sectoral trends can significantly impact the performance of midcap and small cap stocks. For example, if a particular sector experiences rapid growth or a downturn, it can affect the overall returns of stocks within that sector. Industries like technology, healthcare, and consumer goods have historically been known to drive returns in the midcap and small cap segments due to their growth potential and market demand.

Examples of Sectoral Impact

- Technology Sector: The technology sector has been a major driver of returns in the midcap and small cap segments, with companies focusing on innovation and digital transformation.

- Healthcare Sector: Healthcare companies, especially those involved in pharmaceuticals and biotechnology, have shown strong growth potential and have contributed significantly to the returns of midcap and small cap indices.

- Consumer Goods Sector: Companies in the consumer goods sector, including FMCG (Fast-Moving Consumer Goods) companies, have provided consistent returns in the midcap and small cap space due to stable demand and consumer spending.

Conclusive Thoughts

In conclusion, comparing BSE midcap and small cap returns reveals a nuanced landscape of opportunities and challenges for investors. Understanding the historical performance, volatility, and sectoral allocation impact can guide investors in making informed decisions to optimize their investment portfolios.

By delving into these aspects, investors can navigate the dynamic market conditions wisely and capitalize on the potential growth in midcap and small cap stocks.

Popular Questions

What are BSE Midcap and Small Cap indices?

BSE Midcap and Small Cap indices represent the performance of mid-sized and small-sized companies listed on the Bombay Stock Exchange.

How do investment strategies differ between midcap and small cap stocks?

Investment strategies in midcap stocks often focus on growth potential, while small cap stocks tend to be more volatile and offer higher growth opportunities.

What factors influence the historical performance of midcap and small cap indices?

Factors such as market conditions, economic trends, and sectoral performance can significantly impact the historical performance of midcap and small cap indices.