Compare auto insurance rates online sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the benefits, factors to consider, and how-tos of comparing auto insurance rates online can lead to informed decisions and potential savings.

Benefits of Comparing Auto Insurance Rates Online

When it comes to finding the best auto insurance coverage, comparing rates online can offer numerous advantages. Not only can it help you save money, but it also makes the process of finding the right policy much more convenient and efficient.

Cost Savings

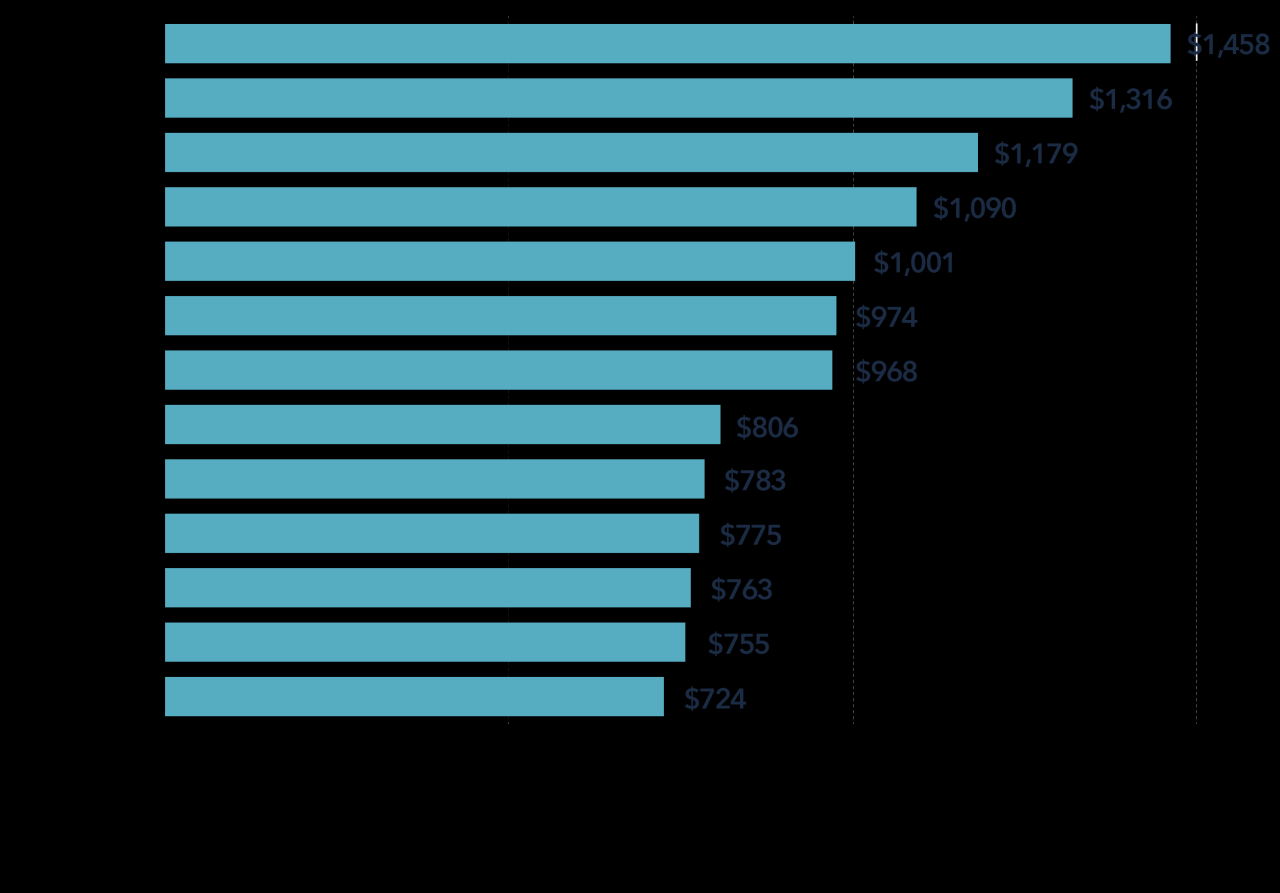

- By comparing auto insurance rates online, you can easily find the most affordable options available in the market.

- Online comparison tools allow you to input your information once and receive multiple quotes from different insurance providers, saving you time and effort.

- Many insurance companies offer exclusive online discounts and promotions that may not be available through traditional channels.

Convenience and Ease of Comparison

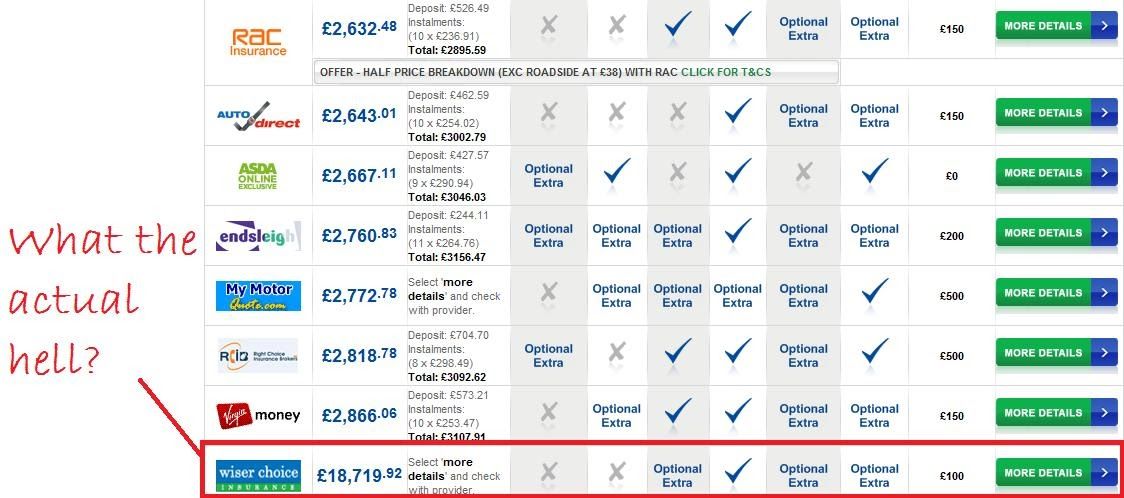

- Online tools provide a user-friendly interface that allows you to compare various insurance policies side by side, helping you make an informed decision.

- You can easily adjust coverage options and deductibles to see how they impact the overall cost of your insurance premium.

- Accessing online reviews and customer feedback can also give you valuable insights into the reputation and customer service of different insurance companies.

Factors to Consider When Comparing Auto Insurance Rates Online

When comparing auto insurance rates online, there are several key factors to consider that can have a significant impact on the coverage you receive and the cost of your policy. Understanding these factors is crucial in making an informed decision about your auto insurance.

Coverage Types, Deductibles, and Discounts

One of the most important factors to consider when comparing auto insurance rates online is the coverage types offered by different insurance companies. It’s essential to look at what each policy covers and whether it meets your specific needs. Additionally, consider the deductibles associated with each policy – the amount you will have to pay out of pocket before your insurance kicks in.

Lower deductibles usually mean higher premiums, so it’s important to find a balance that works for you.

Furthermore, many insurance companies offer discounts that can help lower your premium. These discounts can vary from company to company and may be based on factors such as your driving record, the safety features of your vehicle, or even your membership in certain organizations.

Be sure to inquire about available discounts when comparing auto insurance rates online.

Importance of Understanding Policy Details

Before making a decision about which auto insurance policy to choose, it’s crucial to thoroughly understand the policy details. This includes knowing exactly what is covered, what is excluded, and what your financial responsibilities are in the event of an accident.

By understanding these details, you can avoid any surprises down the road and ensure that you have the coverage you need.

Impact of Personal Driving History

Your personal driving history can have a significant impact on the auto insurance rates you are quoted online. Factors such as your driving record, the number of accidents or tickets you’ve had, and the number of years you’ve been licensed can all influence the cost of your insurance.

It’s important to be honest about your driving history when comparing rates online, as providing inaccurate information could result in higher premiums or even a denied claim in the future.

How to Compare Auto Insurance Rates Online

When comparing auto insurance rates online, it’s essential to follow a systematic approach to ensure you get accurate and reliable quotes. Here is a step-by-step guide to help you navigate the process smoothly.

Types of Information Needed for Accurate Insurance Quotes

- Personal Information: Provide details such as your age, gender, marital status, and address.

- Vehicle Information: Include the make, model, year, and VIN number of your car.

- Driving History: Be prepared to share your driving record, including any accidents or traffic violations.

- Coverage Needs: Determine the type of coverage you require, such as liability, comprehensive, or collision.

- Current Policy Details: Have information about your current insurance policy handy for comparison purposes.

Tips to Ensure Reliable and Comprehensive Quotes

- Compare Apples to Apples: Make sure you are comparing similar coverage levels and deductibles for an accurate comparison.

- Check for Discounts: Look for available discounts based on your driving habits, vehicle safety features, or bundled policies.

- Read Reviews: Research the insurance companies offering the quotes to ensure they have a good reputation for customer service and claims processing.

- Review Policy Details: Understand the fine print of each insurance quote, including coverage limits, exclusions, and claim procedures.

- Use Online Tools: Take advantage of comparison websites and tools to streamline the process and access multiple quotes at once.

Utilizing Online Tools for Comparing Auto Insurance Rates

When it comes to comparing auto insurance rates online, utilizing the right tools can make the process much easier and more efficient. Online tools provide you with the ability to compare multiple insurance quotes from different providers in a matter of minutes, helping you find the best coverage at the most competitive rates.

Comparison Websites

- Comparison websites are platforms that allow you to input your information once and receive quotes from multiple insurance companies.

- These websites streamline the comparison process by providing you with side-by-side comparisons of coverage options and prices.

- Popular comparison websites include Insurify, Compare.com, and The Zebra.

Insurance Company Websites

- Many insurance companies also offer online tools on their websites that allow you to get quotes and compare rates.

- By visiting individual insurance company websites, you can explore the specific coverage options they offer and compare prices directly.

- Some well-known insurance companies with user-friendly online tools include Geico, Progressive, and State Farm.

Independent Agent Platforms

- Independent agent platforms, such as Gabi or Jerry, provide a personalized approach to comparing auto insurance rates online.

- These platforms work with multiple insurance carriers and help you find the best rates based on your unique needs and preferences.

- Independent agent platforms often offer additional services like policy management and claims assistance.

Final Thoughts

In conclusion, the world of online auto insurance rate comparison is a vast landscape filled with opportunities for savings and informed decision-making. By utilizing the tools and knowledge gained from this guide, you can navigate this terrain with confidence and ease.

FAQ Overview

What are some key benefits of comparing auto insurance rates online?

Comparing rates online allows you to easily explore different options, potentially saving money and time in the process.

How can personal driving history impact insurance rates?

Your driving history, including accidents and violations, can influence the rates you are quoted for auto insurance.

What factors should I consider when comparing auto insurance rates online?

Consider coverage types, deductibles, discounts, and policy details to make an informed decision that suits your needs.