Regulations around share economy platforms in Europe: Navigating the Legal Landscape

Delving into the intricate world of share economy platforms in Europe, this exploration unveils the complex web of regulations that govern this innovative sector. Brace yourself for a deep dive into the evolving legal framework shaping the future of sharing economies.

From the impact on traditional industries to the challenges faced by regulators, this overview sets the stage for a comprehensive look at the regulatory landscape of share economy platforms in Europe.

Table of Contents

ToggleOverview of Share Economy Platforms

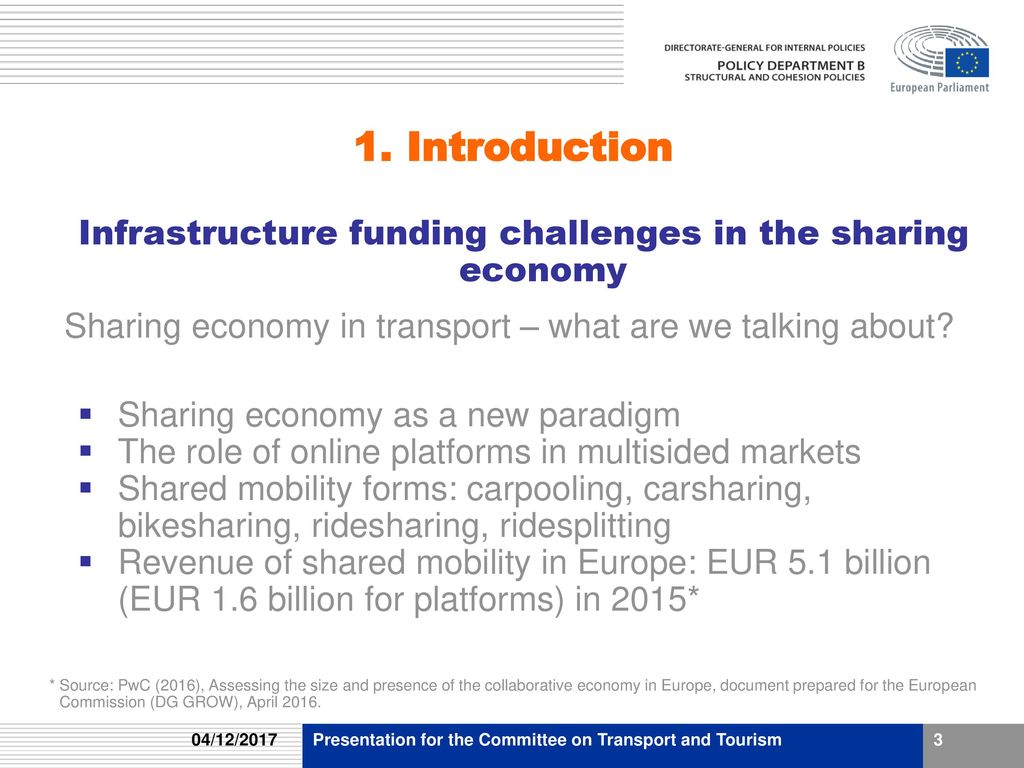

The concept of share economy platforms revolves around the idea of individuals sharing resources, services, or assets with others for a fee or mutual benefit. These platforms act as intermediaries, connecting providers and consumers in a peer-to-peer network.

Key Players and Popular Platforms in Europe

- Uber: A popular ride-sharing platform that has disrupted the traditional taxi industry in many European cities.

- Airbnb: Known for its short-term rental services, Airbnb has revolutionized the hospitality sector by allowing individuals to rent out their properties to travelers.

- Blablacar: This carpooling platform enables users to share rides and split travel costs, reducing the environmental impact of single-occupancy vehicles.

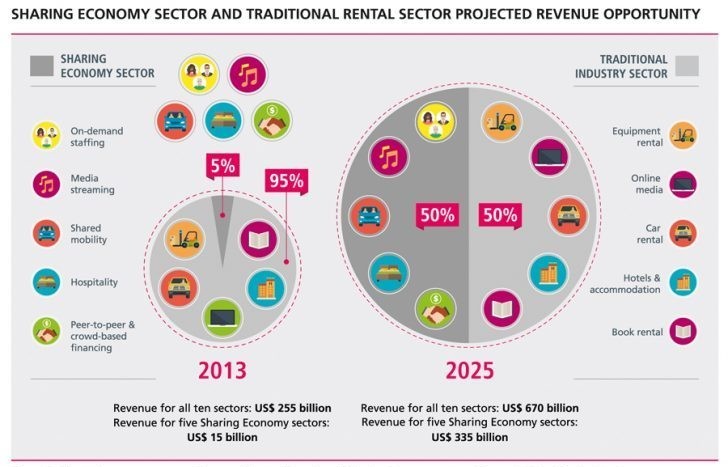

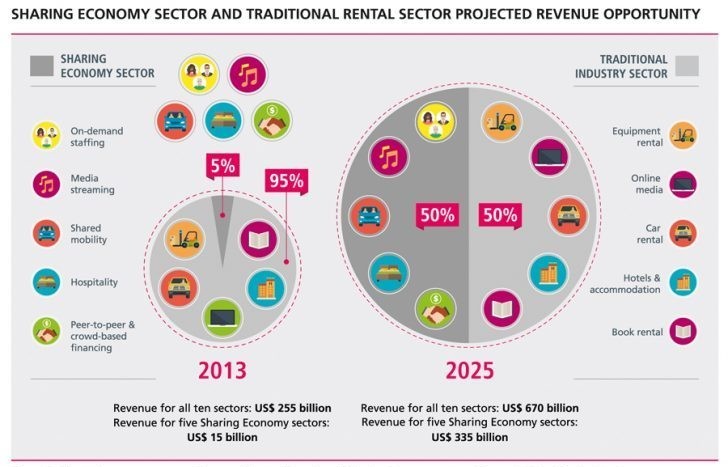

Share economy platforms have challenged traditional industries by providing more affordable and convenient alternatives to consumers.

Impact of Share Economy Platforms on Traditional Industries

- Transportation: Share economy platforms like Uber and Blablacar have posed a significant threat to traditional taxi services and public transportation systems.

- Hospitality: Airbnb has disrupted the hotel industry by offering unique accommodation options at competitive prices, attracting a new segment of travelers.

- Retail: Online marketplaces such as Etsy and Depop have enabled individuals to sell handmade or vintage goods, challenging traditional retail stores.

Current Regulatory Landscape

The regulatory landscape surrounding share economy platforms in Europe is a complex and evolving one. Various countries have implemented different regulations to address the challenges posed by these platforms, which operate in a unique digital environment. Regulators are constantly adapting to keep pace with the rapid growth of the share economy model while also ensuring consumer protection and fair competition.

Regulations in Different European Countries

In Europe, different countries have taken varying approaches to regulating share economy platforms. For example, countries like France and Germany have introduced specific laws to govern platforms like Uber and Airbnb, imposing restrictions on their operations to protect traditional industries and ensure compliance with labor laws.

On the other hand, countries like the UK and Sweden have opted for a more hands-off approach, allowing market forces to shape the development of the share economy.

Challenges Faced by Regulators

Regulators face several challenges in adapting to the share economy model. One major challenge is the difficulty of enforcing regulations on platforms that operate across borders, making it hard to hold them accountable for compliance with local laws. Additionally, the rapid pace of technological innovation in the share economy presents a challenge for regulators to keep up with new business models and practices.

Another key challenge is balancing the need to foster innovation and competition with the need to protect consumers and workers from potential risks associated with the share economy.

Consumer Protection Measures

Consumer protection measures play a crucial role in ensuring the safety and rights of users on share economy platforms. These regulations are designed to promote fair practices, transparency, and accountability among platform operators and users alike.

Regulations Ensuring Fair Practices

- Platforms are required to provide clear and accurate information about the services offered, pricing, terms and conditions, and any additional fees to users.

- Regulations mandate that platforms establish dispute resolution mechanisms to address any conflicts or issues that may arise between users.

- Consumer protection laws also require platforms to implement measures to protect users' personal information and data privacy.

Role of Platforms in Safeguarding Consumer Rights

- Share economy platforms are responsible for verifying the identity and credentials of service providers to ensure they meet the necessary qualifications and standards.

- Platforms must facilitate communication between users and provide channels for feedback and reviews to maintain quality standards and accountability.

- In the event of service quality issues or disputes, platforms are expected to intervene and help resolve conflicts in a fair and timely manner.

Labor and Employment Laws

In the realm of share economy platforms in Europe, the impact on labor and employment laws is a crucial aspect to consider. The rise of gig economy has brought forth new challenges and opportunities in terms of how workers are classified, their rights, and the overall working conditions they face.

Classification of Workers in the Gig Economy

The classification of workers in the gig economy is a contentious issue. Many workers in these platforms are classified as independent contractors, which often leads to them being excluded from traditional labor protections such as minimum wage, benefits, and social security contributions.

This classification can have significant implications on the financial stability and security of workers, as well as their access to essential benefits.

- Worker Misclassification: Share economy platforms often classify their workers as self-employed contractors rather than employees, which can lead to exploitation and lack of essential labor protections.

- Implications on Benefits: Independent contractors in the gig economy typically do not receive benefits such as health insurance, paid leave, or retirement contributions, leaving them vulnerable in times of need.

- Legal Challenges: There have been legal challenges in various European countries to reclassify gig economy workers as employees to ensure they receive adequate protections and benefits.

Regulations on Minimum Wage and Working Conditions

Regulations around minimum wage, benefits, and working conditions for workers in the gig economy are essential to protect their rights and ensure fair treatment.

It is crucial for policymakers to establish clear guidelines and regulations to address the challenges faced by workers in the gig economy, including ensuring fair wages, access to benefits, and safe working conditions.

- Minimum Wage: Setting a minimum wage for gig economy workers can help ensure they receive fair compensation for their work, regardless of their classification as independent contractors.

- Benefits: Regulations should mandate that gig economy workers have access to benefits such as healthcare, paid leave, and retirement contributions to ensure their well-being and financial security.

- Working Conditions: Establishing standards for working conditions, including safety measures and maximum working hours, can help protect gig economy workers from exploitation and ensure a healthy work environment.

Taxation and Compliance

When it comes to taxation in the share economy sector, both individuals and businesses operating on these platforms need to be aware of their obligations. This includes understanding the tax implications of their earnings and ensuring compliance with regulations set forth by tax authorities.

Tax Implications for Individuals and Businesses

Individuals and businesses that earn income through share economy platforms are required to report this income to the tax authorities. This can include income earned from providing services, renting out property, or selling goods through these platforms. Failure to report this income accurately can lead to penalties and legal consequences.

Enforcement and Compliance Monitoring

Tax regulations in the share economy sector are enforced through various means, including data sharing agreements between platform operators and tax authorities. This allows tax authorities to monitor income earned on these platforms and ensure that individuals and businesses are complying with their tax obligations.

Efforts to Ensure Fair Taxation

Efforts are being made to ensure fair taxation within the share economy sector and prevent tax evasion. This includes implementing measures to increase transparency around income earned on these platforms, as well as providing guidance to users on their tax obligations.

By promoting compliance and fair taxation, the aim is to create a level playing field for all participants in the share economy.

Future Regulatory Trends

The future of regulations around share economy platforms is likely to see a continued evolution to keep up with the rapidly changing landscape of the digital economy. As these platforms become more mainstream and influential, regulators will need to adapt and refine existing frameworks to ensure fair competition, consumer protection, and compliance with labor laws.

Increased Transparency and Accountability

In the future, regulations may focus on increasing transparency and accountability for share economy platforms. This could involve requirements for platforms to disclose more information about pricing structures, service quality, and data handling practices to build trust with consumers and regulators.

Enhanced Data Privacy Regulations

With the growing concerns over data privacy and security, future regulatory trends may include stricter rules around how share economy platforms collect, store, and use personal data. This could involve implementing measures to protect user information and prevent unauthorized access or misuse.

Collaboration with Technology Innovations

Regulators are likely to collaborate with technology innovations to develop solutions for regulating share economy platforms effectively. This could involve leveraging tools like artificial intelligence and blockchain to monitor compliance, detect fraudulent activities, and ensure fair practices within the industry.

Last Recap

As we conclude this journey through the regulatory maze surrounding share economy platforms in Europe, one thing becomes clear: the balancing act between innovation and regulation is a delicate dance with far-reaching implications. Stay tuned for more insights and developments in this ever-evolving landscape.

FAQ Explained

What are the key players in the share economy platform industry in Europe?

In Europe, notable players in the share economy platform industry include companies like Airbnb, Uber, and Deliveroo.

How do regulations ensure consumer protection on share economy platforms?

Regulations often require platforms to implement safety measures, provide transparent information, and offer dispute resolution mechanisms to protect consumers.

What tax implications do individuals face when operating on share economy platforms in Europe?

Individuals operating on share economy platforms may need to comply with tax regulations related to income earned through these platforms, which can vary by country.

Related posts

Why Millennials Embrace the Share Economy in 2025: A Look into the Future

How the Share Economy is Disrupting Traditional Business Models

Most popular

- Monetizing underused assets in the digital share economy: Unlocking Hidden Value

- The future of job creation in the platform share economy: Shaping Opportunities in a Digital Era

- Global Challenges of Trust in Digital Share Economies: Navigating the Digital Landscape

- How Digital Platforms Enable Equitable Value Sharing: Exploring Mechanisms and User Empowerment

- How freelancers benefit from the global share economy: A Comprehensive Guide