SaaS Profit-Sharing Models That Attract Global Investors

As SaaS profit-sharing models that attract global investors takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the realm of SaaS business, profit-sharing models have emerged as a key attraction for global investors, promising mutually beneficial partnerships and enticing opportunities for growth and success. This article delves into the nuances of these models, shedding light on their significance and impact in the dynamic landscape of investment and entrepreneurship.

Introduction to SaaS Profit-Sharing Models

SaaS profit-sharing models refer to a business strategy where SaaS companies offer a portion of their profits to investors in exchange for funding. This model is particularly attractive to global investors due to its potential for high returns and passive income.

Importance of Attracting Global Investors

Global investors bring in diverse perspectives, expertise, and capital that can help SaaS companies scale their operations internationally. By attracting global investors, SaaS companies can access new markets, networks, and resources that can drive growth and innovation.

Benefits of Implementing Profit-Sharing Models

- Increased Access to Funding: Profit-sharing models provide SaaS companies with an alternative source of funding beyond traditional venture capital or loans.

- Alignment of Interests: By sharing profits with investors, SaaS companies align the incentives of both parties towards achieving sustainable growth and success.

- Risk Mitigation: Sharing profits with investors can help distribute the risks associated with running a SaaS business, making it a more attractive investment opportunity.

- Global Expansion Opportunities: Profit-sharing models can attract global investors who can provide valuable insights and connections to support international expansion strategies.

Types of Profit-Sharing Models in SaaS

Profit-sharing models in the SaaS industry can take various forms, each with its own advantages and considerations. Two common types are revenue-sharing and equity-sharing models.

Revenue-sharing vs. Equity-sharing Models

Revenue-sharing models involve distributing a percentage of the revenue generated by the SaaS product or service among stakeholders. This can be an attractive option for investors looking for short-term returns and a clear connection between their investment and the revenue generated.On the other hand, equity-sharing models grant investors a stake in the company in exchange for their investment.

This means that investors become partial owners of the business and share in its profits over the long term. While this can offer potentially higher returns if the company grows significantly, it also involves more risk and a longer time horizon for realizing profits.

Examples of Successful Profit-Sharing Models in SaaS

One notable example of a successful profit-sharing model in the SaaS industry is Dropbox's referral program. By offering users additional storage space for referring new customers, Dropbox effectively incentivized its users to promote the service, leading to a significant increase in customer acquisition and revenue.Another example is Slack's freemium model, where users can access basic features for free but pay for premium features.

This model has allowed Slack to attract a large user base while also generating revenue from users willing to pay for additional features.

Hybrid Profit-Sharing Arrangements

Hybrid profit-sharing arrangements combine elements of both revenue-sharing and equity-sharing models. For example, some SaaS companies may offer investors a combination of revenue share and equity stake to provide a balance between short-term returns and long-term growth potential.These hybrid models can be attractive to investors who want to benefit from the immediate revenue generated by the SaaS product while also having a stake in the company's future success.

However, they can also be complex to structure and may require careful consideration of the terms and conditions to ensure a fair and mutually beneficial arrangement for all parties involved.

Factors Influencing Global Investor Attraction

In today's global market, various factors play a crucial role in attracting investors to SaaS profit-sharing models. These factors include market trends, geographical considerations, and regulatory environments that impact the decision-making process of international investors.

Impact of Market Trends on Investor Interest

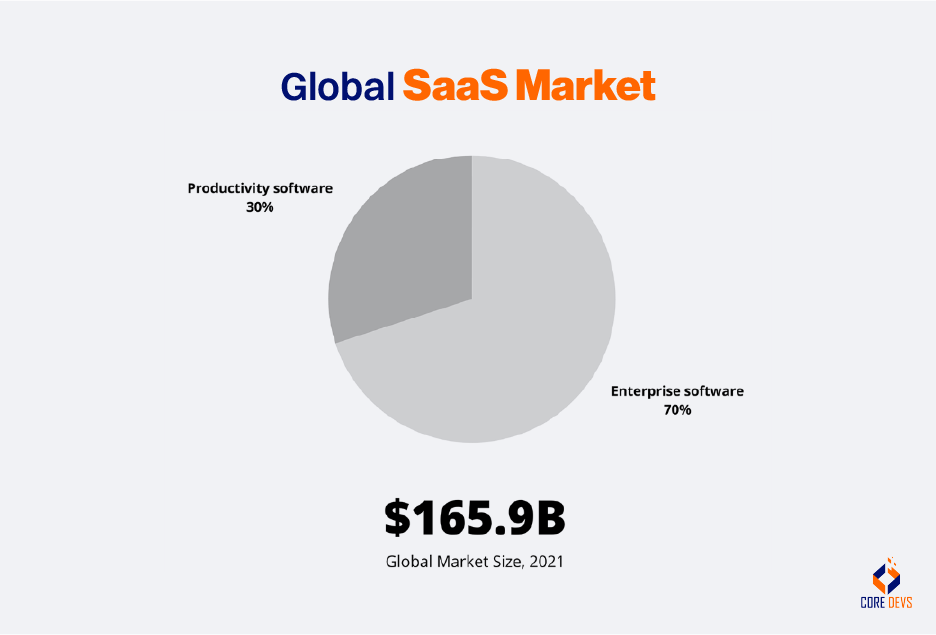

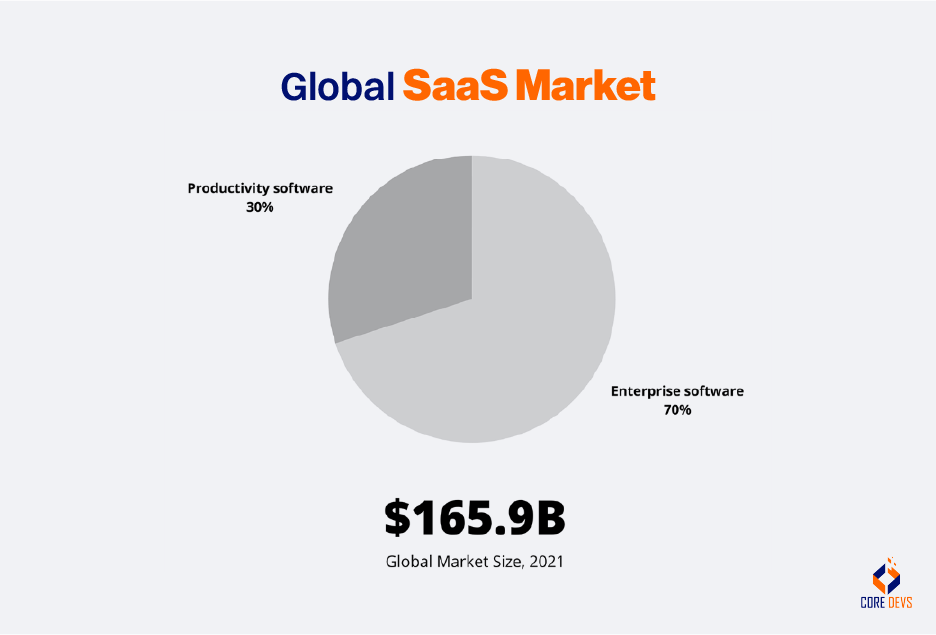

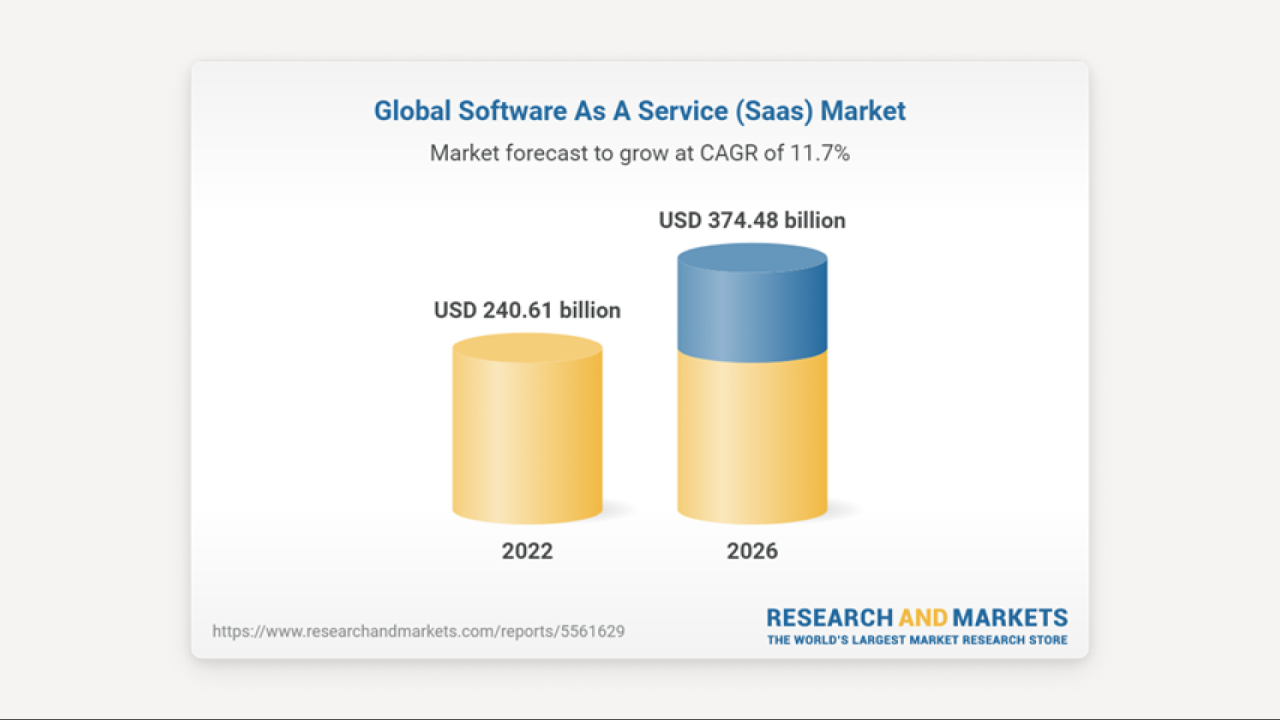

Market trends have a significant influence on investor interest in SaaS profit-sharing models. Investors are often drawn to sectors experiencing rapid growth and innovation. As SaaS continues to disrupt traditional business models and offer scalable solutions, investors are increasingly interested in this sector.

The shift towards cloud-based services and the growing demand for software solutions further contribute to the attractiveness of SaaS profit-sharing models.

Geographical Factors in Profit-Sharing Model Selection

Geographical factors also play a crucial role in the choice of profit-sharing models for global investors. Investors often consider factors such as market size, economic stability, and regulatory frameworks when deciding where to invest. Emerging markets with a high growth potential may attract investors looking for new opportunities, while established markets provide stability and a proven track record.

The geographical location of a SaaS company can influence investor preferences and impact the selection of profit-sharing models.

Role of Regulation and Compliance in International Investment

Regulation and compliance are essential considerations for international investors evaluating SaaS profit-sharing models. Investors seek jurisdictions with clear regulatory frameworks that protect their investments and ensure legal compliance. Transparent governance structures, intellectual property protections, and data privacy regulations are critical factors that influence investor confidence.

Companies that demonstrate a commitment to regulatory compliance and adhere to international standards are more likely to attract global investors seeking secure and sustainable investment opportunities.

Strategies to Design Profit-Sharing Models

When designing profit-sharing models to attract global investors, it is crucial to consider key factors that can enhance investor engagement and promote transparency and communication.

Structuring Profit-Sharing Agreements

One important aspect of designing profit-sharing models is structuring the profit-sharing agreements in a way that appeals to global investors. This involves clearly outlining the terms, conditions, and profit distribution mechanisms to ensure transparency and trust between the investors and the SaaS company.

- Define clear profit-sharing percentages: Establishing a clear and fair breakdown of how profits will be shared among investors is essential. This clarity helps build confidence and encourages more investors to participate.

- Include performance-based incentives: By incorporating performance-based incentives in the profit-sharing agreements, investors can see the direct impact of their contributions on the success of the SaaS company. This can motivate investors to actively engage and support the growth of the business.

- Implement vesting schedules: Setting up vesting schedules can ensure that investors are committed to the long-term success of the SaaS company. This helps align the interests of investors with the company's goals and prevents early withdrawal of investments.

Importance of Transparency and Communication

Transparency and communication play a vital role in fostering trust and maintaining strong relationships with global investors in profit-sharing models.

- Regular financial reporting: Providing regular and detailed financial reports to investors helps keep them informed about the performance of the SaaS company and the distribution of profits. This transparency can enhance investor confidence and loyalty.

- Open communication channels: Establishing open and clear communication channels with investors allows for feedback, questions, and concerns to be addressed promptly. This two-way communication fosters a sense of partnership and collaboration between investors and the SaaS company.

- Adherence to legal and regulatory requirements: Ensuring compliance with legal and regulatory requirements in profit-sharing agreements is essential for building trust and credibility with global investors. By adhering to industry standards and regulations, the SaaS company demonstrates a commitment to ethical business practices.

Conclusion

In conclusion, SaaS profit-sharing models stand as innovative mechanisms that not only captivate global investors but also pave the way for collaborative ventures brimming with potential. As businesses strive to navigate the complexities of the digital realm, these models offer a strategic approach towards sustainable growth and lucrative partnerships.

With a keen focus on transparency, communication, and adaptability, SaaS companies can harness the power of profit-sharing arrangements to forge lasting connections and drive impactful outcomes in the ever-evolving market.

Questions and Answers

What are some common types of profit-sharing models in the SaaS industry?

Common types include revenue-sharing and equity-sharing models, each offering distinct advantages and considerations for both companies and investors.

How do market trends influence investor interest in SaaS profit-sharing models?

Market trends play a crucial role in shaping investor sentiment towards profit-sharing models, reflecting changing preferences and opportunities within the industry.

What key considerations should be kept in mind when designing profit-sharing models to attract global investors?

Key considerations include aligning incentives, ensuring scalability, and fostering transparency to build trust and engagement with international investors.